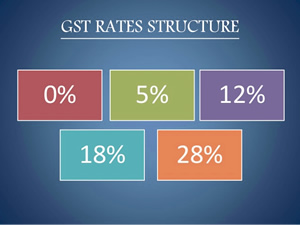

The powerful GST council headed by finance minister Arun Jaitley is likely to limit the tax rate on services under the new indirect tax regime that will come into force on 1 July to just two slabs—12% and 18%. Goods are to be taxed at five different rates.

A panel within the council discussing the tax slabs under the goods and services tax (GST) regime will meet in the capital on Tuesday and Wednesday and identify what all services should fall into which of the two slabs, a person with direct knowledge of the matter said on condition of anonymity.

It will then be placed before the council’s two-day meeting in Srinagar, starting on 18 May.

Businesses have demanded a lower rate of 5% on services, which has not found favour within the council.

Services account for more than half of the country’s $2.3 trillion gross domestic product, or GDP.

At present, services are taxed by the central government at a flat 15% but relief (called abatement) is given to a host of transactions by restricting levy of the tax to 40-60% of the value of the transaction. The proposed two rates will be applied in such a way that the GST rate on services is closer to existing effective service tax outgo on the transaction.

Experts said that services which currently attract 15% tax will move up to 18% GST rate, while those enjoying the benefit of abatement and hence have a lower effective tax outgo at present will come under 12% GST.

The non-availability of full credit for taxes previously paid on raw materials under the current system means the actual service tax incidence at present on a transaction is higher than what the applicable tax rate implies. However, in the GST regime, seamless availability of tax credits would help in reducing the impact of an increase in the tax rate.

“The inflationary impact on account of an increase in the tax rate on services under GST may not be directly proportional to such increase, but will be much lower,” said Bipin Sapra, tax partner at the consulting firm EY.

The ‘rate fitment’ panel meeting will also discuss how to place different goods in the five slabs—5%, 12%, 18%, 28% and 28% plus cess. Commodities which at present have excise duty exemption but attract state-level value-added tax (VAT) may be placed under the 5% GST slab. Those with concessional excise duty and VAT will be placed under the 12% or 18% rates. Items that currently come under peak excise and VAT rates will attract 28% GST while luxury items will come under the 28% plus cess category.

A panel within the council discussing the tax slabs under the goods and services tax (GST) regime will meet in the capital on Tuesday and Wednesday and identify what all services should fall into which of the two slabs, a person with direct knowledge of the matter said on condition of anonymity.

It will then be placed before the council’s two-day meeting in Srinagar, starting on 18 May.

Businesses have demanded a lower rate of 5% on services, which has not found favour within the council.

Services account for more than half of the country’s $2.3 trillion gross domestic product, or GDP.

At present, services are taxed by the central government at a flat 15% but relief (called abatement) is given to a host of transactions by restricting levy of the tax to 40-60% of the value of the transaction. The proposed two rates will be applied in such a way that the GST rate on services is closer to existing effective service tax outgo on the transaction.

Experts said that services which currently attract 15% tax will move up to 18% GST rate, while those enjoying the benefit of abatement and hence have a lower effective tax outgo at present will come under 12% GST.

The non-availability of full credit for taxes previously paid on raw materials under the current system means the actual service tax incidence at present on a transaction is higher than what the applicable tax rate implies. However, in the GST regime, seamless availability of tax credits would help in reducing the impact of an increase in the tax rate.

“The inflationary impact on account of an increase in the tax rate on services under GST may not be directly proportional to such increase, but will be much lower,” said Bipin Sapra, tax partner at the consulting firm EY.

The ‘rate fitment’ panel meeting will also discuss how to place different goods in the five slabs—5%, 12%, 18%, 28% and 28% plus cess. Commodities which at present have excise duty exemption but attract state-level value-added tax (VAT) may be placed under the 5% GST slab. Those with concessional excise duty and VAT will be placed under the 12% or 18% rates. Items that currently come under peak excise and VAT rates will attract 28% GST while luxury items will come under the 28% plus cess category.

Source : Live Mint